The circular addresses the withholding tax treatment of dividends and interest received by QFIIs from PRC resident companies. Kenya provides a useful example to our revenue authority in order to avoid the same pitfalls.

What Is The Double Entry For Withholding Tax Quora

Therefore you should consult the tax authorities of the state in which you live to find out if that state taxes the income of individuals and if so whether the tax applies to any of your income or whether your income tax treaty applies in the state in which you live.

. Stocks you may want to avoid dividend. The installation fee of RM100000 is subject to 10 Malaysian withholding tax. To name a few.

For a full list of withholding taxes under. For example in the UK the CGT is currently tax year 202122. There are four ways you can reduce the amount of withholding tax on your dividends.

So what does withholding VAT mean for the ordinary taxpayer. If however there has been a single purchase transaction of at least P10000 withholding tax has to be applied. You will usually use this.

How to Pay Less Dividend Withholding Tax. As a general rule corporations resident in Canada are subject to Canadian corporate income tax CIT on worldwide income. In the Sales tax section click Manage sales tax.

As part of the deal JP Corp sent 3 engineers to Malaysia to assist in the installation of the machine and charged RM100000 for the installation services. Click the pencil icon. Based on the facts if it is proven that the service is rendered in Malaysia then the fees or the commission received by sookaTravel is subject to withholding tax under section 109B ITA 1967.

ABC Sdn Bhd purchased a specialised machine from JP Corp a Japanese company. The withholding VAT system in Kenya has evolved over the years to a current system where only 6 out of the standard 16 VAT charged is withheld ie 375 of the total VAT. According to the Inland Revenue Board of Malaysia an EA form Malaysia also refer to Borang EA EA Statement EA Employee is an Annual Remuneration Statement that every employer shall prepare and render to his employee statement of remuneration of that employee before 1st March in the year immediately following the first mentioned year.

Hence if you wish to invest in US. Malaysia has imposed capital gain tax on share options and share purchase plan received by employee starting year 2007. Malaysia has signed tax treaties with over 75 countries including most countries in the European Union the United Kingdom China Japan Hong Kong Singapore Australia etc.

If a stock doesnt pay out dividends you are not subjected to the Dividend Withholding Tax. Tax treaties and some states do not. 1 Avoid dividend stocks listed in the US.

On 23 January 2009. Non-resident corporations are subject to CIT on income derived from carrying on a business in Canada and on capital gains arising upon the disposition of taxable Canadian property see Capital gains in the Income determination section for more. In the same row as the location where you want to adjust tax rates click the down arrow under Tax option Choose one of the following.

However if it is proven otherwise the withholding tax on services is exempted under Income Tax Exemption No9 Order 2017. Aside from the purchase of goods and services there are other forms of withholding taxes. Or foreign Taxpayer Identification Number TIN except for certain marketable securities and certifies that the foreign person.

Find the region where youd like to change tax settings. The withholding tax rate for both services and royalties is 10 but depending on the tax treaty between Malaysia and the respective countries the rate may be further reduced. A reduced rate of withholding applies to a foreign person that provides a Form W-8BEN or W-8BEN-E claiming a reduced rate of withholding under an income tax treaty only if the foreign person provides a US.

Use Googles preset tax rate for this location. Some states honor the provisions of US. For example rental of buildings requires a 5 withholding tax on the gross rental payment.

Demystifying Malaysian Withholding Tax Re Run Kpmg Malaysia

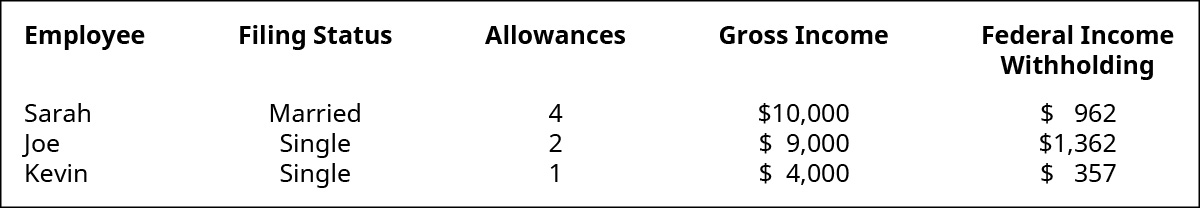

Record Transactions Incurred In Preparing Payroll Principles Of Accounting Volume 1 Financial Accounting

Bbva Bank Statement Template Mbcvirtual Statement Template Bank Statement Templates

25 Great Pay Stub Paycheck Stub Templates Excel Templates Templates Payroll Template

Step By Step Document For Withholding Tax Configuration Sap Blogs

Payroll Tax What It Is How To Calculate It Bench Accounting

Form W 8ben Definition Purpose And Instructions Tipalti

Withholding Tax In Sales Rebate Settlement Sap Blogs

Details Of 2 Agent Commission Withholding Tax L Co

Guide To Claiming The Foreign Tax Credit On Your Dividend Withholding

New Withholding Rules On Payments Of Professional Talent And Commission Fees Grant Thornton

U S Dividend Withholding Tax What Singapore Investors Must Know

Payments That Are Subject To Withholding Tax Wt

- umumnya glukosa dalam darah manusia

- peperiksaan akhir tahun sains tahun 2

- maksud letak nama acah acah

- warna merah putih biru muda

- undefined

- withholding tax malaysia example

- 2017 public holiday malaysia

- international driving license malaysia for foreigners

- logo nama makanan hipster

- khasiat serai wangi

- cara nak kilatkan cermin kereta

- smk alor pasir tanah merah kelantan

- cuka hitam sweet and sour pork

- malaysian labour law overtime calculation

- cahaya kuning terkena pada baju putih

- gambar kepala singa hitam putih

- harga gula merah 1 kg

- jawatan kosong pos laju

- kedai gunting rambut aishah

- faktor yang mempengaruhi petempatan